Jul 26, 2016

The identification of risk in selling certain customers is fundamental to credit management. The type of business organization defines and structures the liabilities attached to such a legal form. And this organization may have more or less risk to the creditor, depending on the entity type.

In the beginning . . .

When starting a business, the owner picks an entity type of legal organization and a name. This organization will determine liability for the obligations of the entity. For example, as a sole proprietor, the owner is personally liable for debts of the business. This form benefits the smaller business, making it easier and less complicated to carry on business. At the same time, it carries more risk to the owner than certain other forms and provides access to personal assets – non-business assets – to creditors. A partnership is similar in that the partners are personally liable. The corporation resolves this by making the owner liable only to the amount of the investment in shares. This means, generally, the creditor cannot pursue the individual shareholders for debts of the business. In addition to these three common forms, hybrids such as LLCs and LLPs attempt to mitigate the risk of the individual owner and limit access of the creditor to personal assets. This requires state-by-state research to determine the basics of entity structure in particular States.

Fictitious names

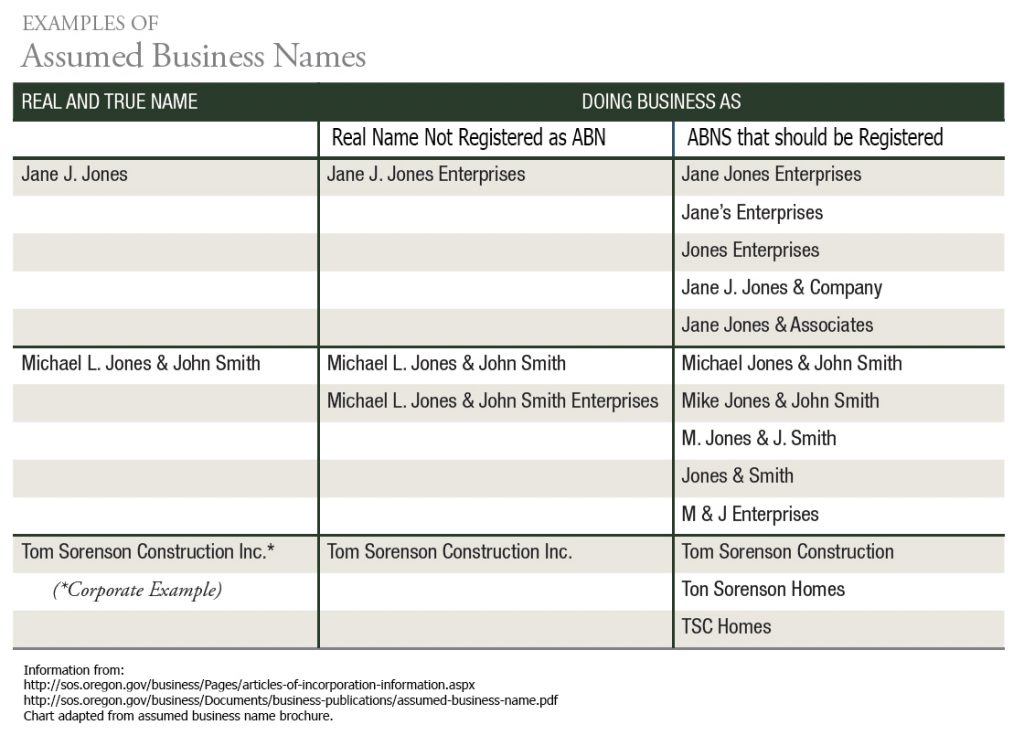

Every company is organized as a legal entity, and every company is known by a certain name or names. Some companies choose to use a fictitious or assumed business name, which does not create a legal obligation, which remains with the legal business entity. Still, the entity must register such assumed business names with the State in which it’s domiciled (registered or established).

Registering with the State

Corporations, LLCs, and other formal businesses must register with the Secretary of State’s office at the time of formation to be authorized as a legal entity to do business. A Sole Proprietor is not required to register if the individual owner is identifiable from the entity name. Partners are not required to register if their names are identifiable in the entity name. Corporations register at the time of authorization, as noted above. For examples of these three common types of business entities, see the chart below.

Verifying legal organization and assumed business names

You may look up the registration of a business by accessing the Secretary of State’s office in the state of domicile:

California

Idaho

Montana

Nevada

Oregon

Washington (Dept of Rev)

Washington (SOS)

List of All States

The State record will show the registration of the legal entity and its current status. In addition, it will provide, at a minimum, information about the date of the registration, any renewals, and the registered agent. The latter party accepts legal documents on behalf of the company and may be an important contact, especially if you have to resort to legal process to resolve an open obligation.

Missing Records, “Inactive” or “Dissolved” Status

If a company is not registered with the Secretary of State, you may not have the correct legal name. Given a creditor’s rights are bound to the legal entity, it’s crucial to know the legal name. Also, companies at times fail to meet State requirements for continuing registration, such as periodically filing reports and/or paying fees. These will be listed as Inactive or Dissolved. Inactive registrations may be activated by meeting the requirements. Should the entity fail to do so, at some point the State will “dissolve” the registration. With either “inactive” and “dissolved” status, individuals operating the business may be personally liable for debts; however, this is a murky area and, frankly, one you may wish to avoid if possible.

For more information

The Secretary of State websites typically have excellent information about registration and assumed business names.