Jan 21, 2021

Written By: Chris Finch, Sumitomo Electric and Scott Blakeley, Blakeley LLP

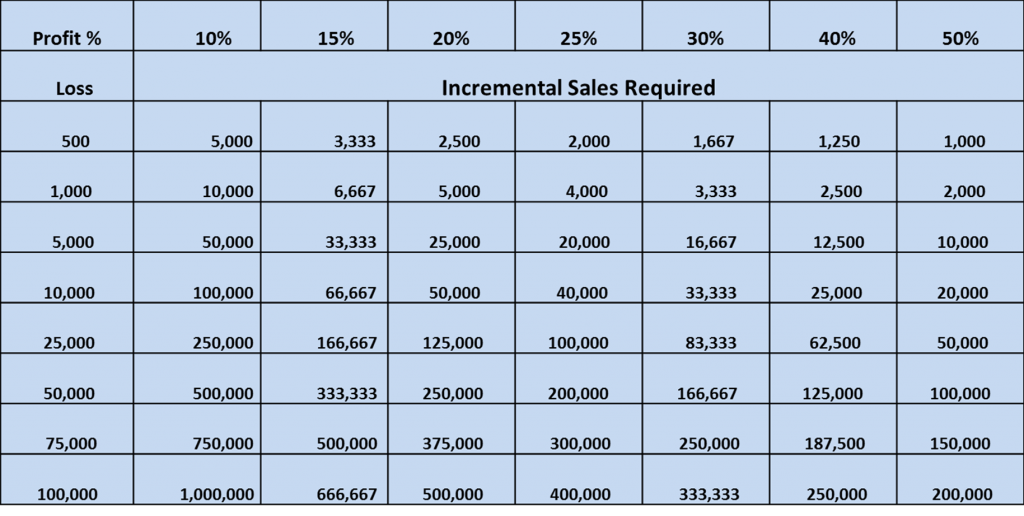

Credit teams are responsible for protecting and maintaining company’s accounts receivable, the most valuable asset for any company. The biggest threat to that asset is fraudulent orders. Fraudulent orders often lead to unrecoverable losses. After a loss of profit through a fraudulent order, companies often need to sell up to three or four times their normal sales to recover the loss profits (see table below).

The best way to manage this threat is to catch fraudulent orders before they have a chance to do any damage. The following information will help you stay ever diligent in your protection against fraudulent orders that could be a threat to your company.

Fraud Prevention

The 5Cs of Fraud Prevention are one way to identify fraud in requests for orders. The 5Cs are:

| Confirmation: | Is it actually the business that is sending the order? Perform any due diligence to confirm the validity of business sending the order. |

| Condition: | Is the business active? Are the executives active? What is the status of the business? Check social media accounts, the business website (in particular the “About Us” page) to confirm. |

| Consistency: | Are the facts stated in the order form consistent with other sources of information? Compare what they gave you with the research you conducted for numbers 1 and 2. |

| Character: | Are there any past issues that could make current or future transactions risky? Check places like the Better Business Bureau or a business credit report. |

| Continuity: | Has there been a sudden change in the customer relationship? Often time’s fraudsters will stay within the terms of the agreement for the first two or three payments and then commit fraud after establishing credibility. Closely monitor your customer accounts and flag those with changed behavior as high risk. |

Know Your Customer!

Many companies are using fraud detection methods to stop a fraudulent order. Know your customer! (Have you heard that before?) The following are some red flags to keep an eye out for and some action steps to help address them, even if the documents submitted appear to be legitimate as it’s easy to get a real company’s letterhead and PO even through the Internet. Don’t assume it’s all legitimate just because the crooks did a good job with their paperwork: While on its own this is not a clear indicator of fraud, fraudsters generally want items quick so companies should be on the lookout for expedited orders.

| Red Flags | Advice |

|---|---|

| 1. The request comes through email for a quote for a new customer never sold to. | Generally, companies should try to make verbal contact in cases like this. |

| 2. The requestor sends a credit application to complete. They may return a standard reference sheet but not complete a credit application. | While large companies may have their own forms to complete, it could be a red flag of fraudulent behavior. |

| 3. The phone number on the request may be suspicious such as an 888 xxx-xxx number. | While it is not impossible for a company to have an 888 number, it is unlikely they would use that to request an order from another company. |

| 4. PO provided is to a drop ship location and not the same as the company’s bill to address. | This alone may not be anything worth worrying about, but coupled with other indicators it could be a red flag. |

| 5. When checking trade references, some or all of the fax #’s don’t work. | Phone numbers of the references should be called and good numbers received to send out requests to. |

| 6. A returned references reports the last sale with this company might have been several years ago. | It is odd that a company would provide such an old reference. Thus another red flag. |

| 7. The request is usually for expedited UPS service. | While on its own this is not a clear indicator of fraud, fraudsters generally want items quick so companies should be on the lookout for expedited orders. |

| 8. The real company should be contacted through a number other than what is shown on the credit application such as from a D&B report. 9. The real company email address is often just slightly different from what is provided such as “companyandxyz” and the email given is “companynxyz”. | This is an enormous red flag and once discovered the real company should be contacted. Emails that also come from Yahoo, Hotmail, or similar services are also a red flag. |

Only one or two of the above factors would probably signal fraud by itself but combined, they add up to not being legitimate.

In one instance when a company received a new order for a drop ship location, and searched the ship to address via Google Earth, it was learned the location was actually a vacant lot. And sometimes the location may be an apartment complex or a mall. You have to ask yourself, does that delivery address make sense for my type of product or not. This kind of vigilance is important in catching fraud before a company loses money.

One more example showcases what can happen when a company does not confirm with its customers when something out of the ordinary happens. A supplier suffered a data breach and the hacker sent out a blanket email to all their customers instructing them to change their banking information. The company in this case called the supplier to confirm the change and that is when they were informed of the hack. Unfortunately, a less attentive company has already made the change to their banking information and ended up wiring quite a large sum to the hackers.

These examples just go to show the level of loss a company can be hit with if they are not cautious and alert when dealing with customer requests. Fraudulent orders can slip through the cracks if credit teams do not employ methods like the ones discussed above to catch fraudulent orders at the door.

Legal Rights

It is important to catch fraudulent orders prior to losing merchandise because successful, cost-effective legal remedies for this type of fraud are limited, due diligence is critical for a vendor. After a vendor has sold to a fraudulent buyer, it is extremely difficult to recover goods or to satisfy a monetary judgment against them.

When the business failure does not involve a bankruptcy filing, a vendor’s prejudgment remedies, such as a writ of attachment or replevin, generally do not bear fruit because the merchandise has been disposed of. And the fraud operator has likely disappeared. Even if the fraudster can be tracked down, he or she usually does not have any easily traceable assets to satisfy a judgment. A vendor may be able to establish other claims against the operator, such as breach of fiduciary duty (where the operator is an officer of its company) or RICO claims. Again, however, these claims usually do not put money back in the vendor’s pocket. They can be expensive to develop.

A vendor’s strongest legal rights may be those against the buyers of the discounted goods. If a vendor can identify its goods that are in the hands of a buyer who has purchased from a fraudulent seller, and the vendor can establish that the buyer did not purchase the merchandise in good faith (i.e., the buyer knew or should have known the transaction was fraudulent and thus was not a bona fide purchaser), the vendor may have a claim against the buyer.

When the business failure includes a bankruptcy filing, a vendor’s legal remedies are also limited. The vendor may be able to convince the bankruptcy trustee of the failed business to pursue the buyers of the discounted merchandise under a fraudulent conveyance theory. The trustee would, however, need funding to pursue such litigation. A vendor may attempt to block the discharge of its claim in the bankruptcy by filing a complaint to determine the dischargeability of its debt where the operator has filed an individual bankruptcy. In either situation, the vendor still faces the problem of locating the operator’s assets.

Another means of combating a fraudulent order is to refer it to the United States Attorney’s Office, the District Attorney, or if the case is in bankruptcy, the Office of the United States Trustee. The U.S. Trustee is an adjunct of the Justice Department and has the responsibility of working with the U.S. Attorney’s Office to investigate bankruptcy crimes. The Bankruptcy Reform Act of 1994 established new criminal penalties for any person fraudulently using a bankruptcy filing to discharge debts.

Conclusion

The warning here is that credit executives must be especially vigilant when furnishing credit to new accounts or even existing accounts but to new ship to locations. Credit executives must closely monitor all accounts for the red flags mentioned above. These steps will help the credit executive avoid selling to a fraudulent buyer and losing thousands of dollars or more. No company wants to join the ranks of defrauded vendors.

Chris Finch, Credit Manager, Sumitomo Electric Lightwave Corp. and ExceLight Communications, Inc.

Scott Blakeley, Esq. is a founder of Blakeley LLP, where he advises companies around the United States and Canada regarding creditors’ rights, commercial law, e-commerce and bankruptcy law. He was selected as one of the 50 most influential people in commercial credit by Credit Today. He is contributing editor for NACM’s Credit Manual of Commercial Law, contributing editor for American Bankruptcy Institute’s Manual of Reclamation Laws, and author of A History of Bankruptcy Preference Law, published by ABI.