Nov 18, 2020

Is Your Accounts Receivable Process Slowing You Down?

In today’s digital economy, a company’s survival hinges on its potential to manage working capital and cash flow while ensuring customer satisfaction along the way. Mid-sized businesses heavily depend on cash for their day-to-day business operations and growth. In times of uncertain economic swings, optimized cash management could make all the difference between simply surviving versus having the edge over your competitors.

Accounts Receivables ( A/R ) is critical to cash flow and a clear indicator of the business’s financial health. Most mid-sized businesses are familiar with the traditional manual, paper-based A/R processes that more often than not, end up hurting the company’s cash conversion cycle. As a result, businesses are inevitably moving towards automating their accounts receivable processes and upgrading their payment landscape by introducing digital payments.

Let’s dive deep into the benefits of digital payments and how A/R automation could help in leveraging digital payments to reduce DSO and improve cash flow.

Digital Payments: What Mid-Sized Businesses Need to Know

Digital payments have proven to be a dominant factor for businesses to improve customer experience and propel revenue growth. These days consumers prefer simpler, faster, and secure payment options.

Accommodating multiple payment options such as same-day ACH, Virtual Cards, and Wire Payment could be the key to fast-track payments, enabling customers to pay in their preferred format. While the shift towards digital payments might seem inevitable in the longer run, A/R teams could use the propulsion of digital transformation to excel in the current economy.

Let’s look at five ways AR automation could help with processing Digital Payments:

- Electronic Invoicing Solution

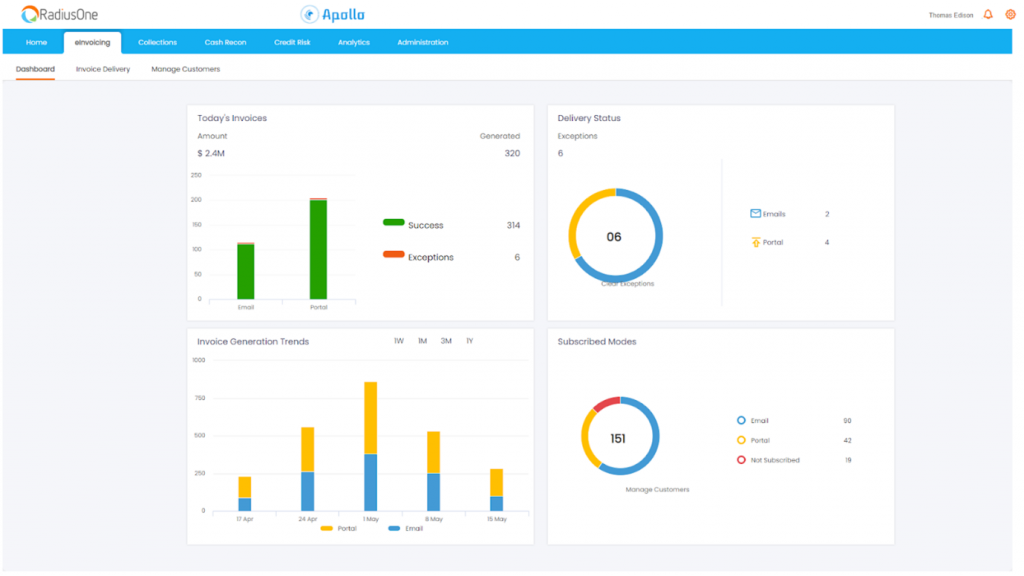

How many times have you encountered situations where the customers were unable to pay because they did not receive an invoice on time? Most mid-sized businesses often stumble across this challenge due to the absence of real-time invoice visibility. While cash is critical for running a business, a lot gets lost in sending invoices by snail mail. Automating the delivery of invoices and account statements across emails and customer portals through an EIPP cloud solution mitigates such errors and helps the account receivable team get paid faster while minimizing loss.

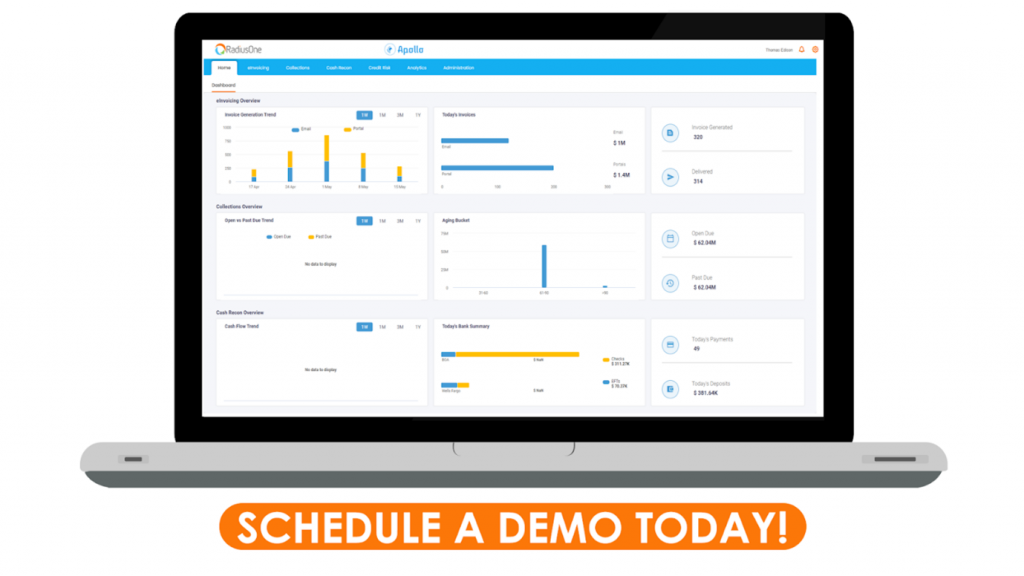

1.1 RadiusOne e-Invoicing Dashboard. Get 360-degree visibility on all the key-invoicing stats, including Overall Invoices, Delivery Status, Invoice Generation Trends, and Subscribed Modes

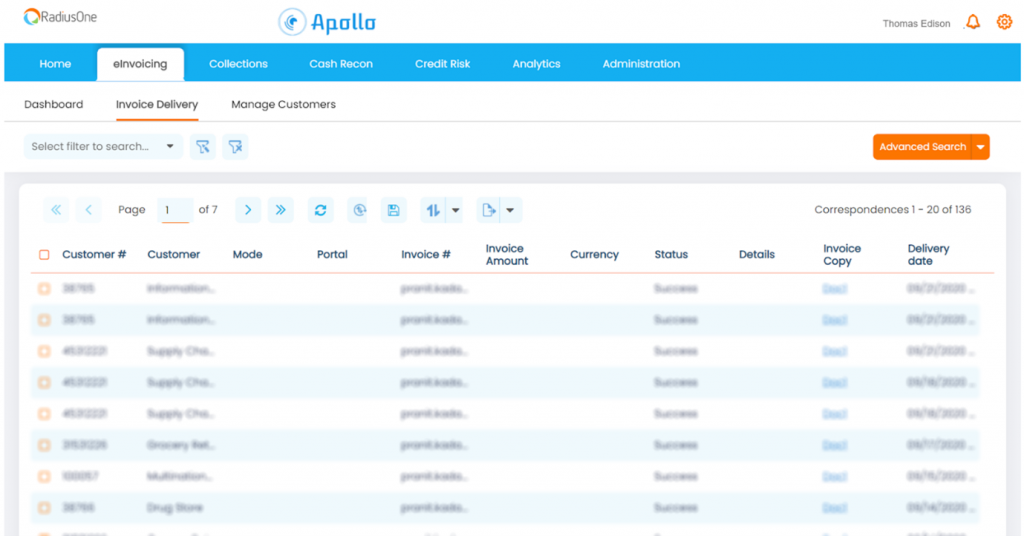

1.2 An overview of the RadiusOne e-Invoicing Invoice Delivery Page. The app automates the delivery of invoices and account statements across emails and customer portals.

- Self-Service Customer Portal With Multiple Payment Options

The core of any company’s success is happy customers. But what makes customers happy? An essential attribute of the customer experience is to make information easily accessible. A self-service portal could enable your customers to access and manage their invoices and account statements anytime, anywhere. Through this self-administered portal, customers can easily make payments with the availability of multiple formats such as ACH, credit cards, virtual cards, or create dispute claims if there are any. The ability to choose a preferred payment option could go a long way in improving customer experience and speeding up the payment process. - Automated Cash Reconciliation

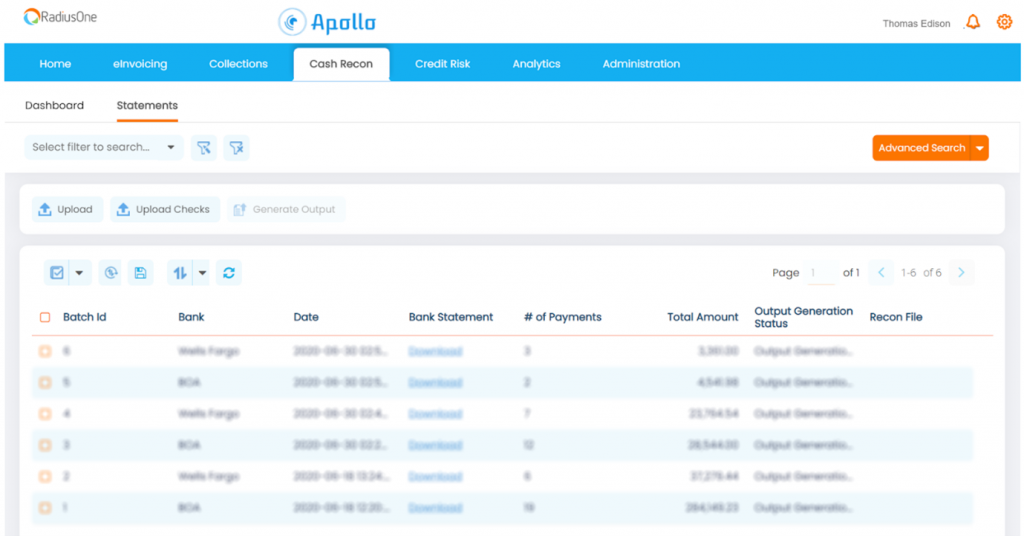

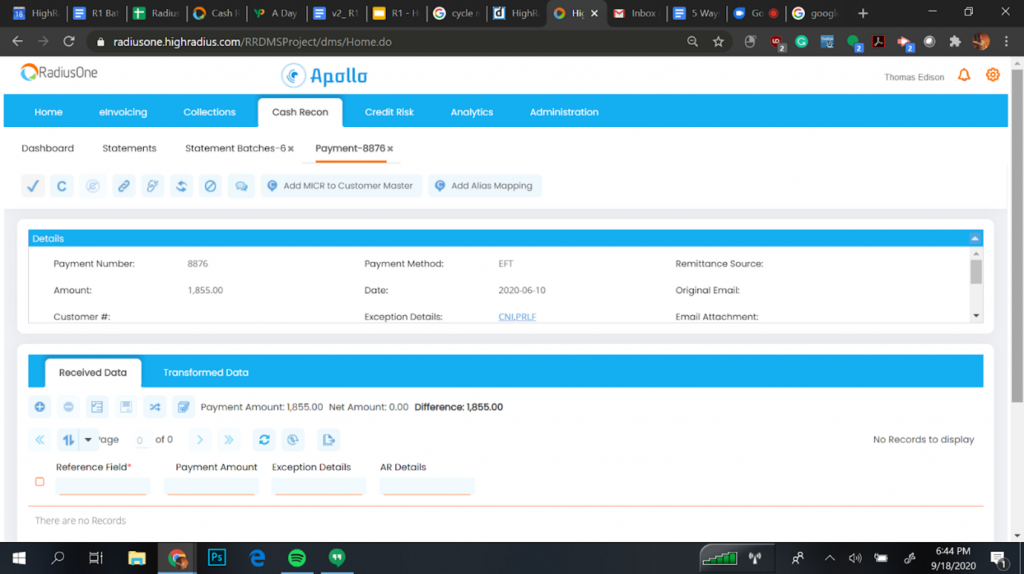

Most mid-sized businesses have to bear the burden of manual reconciliation due to paper-based AR processes. Automating accounts receivables could provide end-to-end automation of the payment reconciliation process that would not only eliminate human errors but also reduce costs by eliminating lockbox key-in fees. Implementing appropriate Cash Reconciliation software could help businesses with – - Remittance Aggregation

Most businesses, while receiving e-payments, get the remittance information separately. The remittance comes in multiple formats(.txt, .csv, MT940, BAI2, .pdf) and through multiple channels (email, web-portals, EDI, fax). Manually gathering remittances from various sources becomes a grueling task for most analysts. Moreover, remittances with a non-standardized format add on to the complexities. Automated Remittance Aggregation ensures auto-capture of remittance data across various sources and formats, allowing businesses to save time and resources while minimizing errors. - Invoice Matching

Along with automated remittance aggregation, having a solution that ensures auto-mapping of invoices with payments could enable straight-through cash processing. Automated invoice matching helps in accurate auto-linking of payments with open invoices and ensures same day cash posting at a line-item level. Moreover, it enables faster identification of disputes and inconsistencies and helps in accelerating the resolution process to fast-track recovery.

3.1 An overview of the statements in Cash Reconciliation software. The application automates the matching of payments with remittances, eliminating lockbox key-in fees, and manual intervention.

3.2 Details of the exception of a particular customer. RadiusOne has an excellent exception handling tool for proactive dispute identification leading to a faster resolution.

- Remote Deposit Capture and Mobile payments

Digital payments are no longer just restricted to cards and payment portals. Most mid-sized businesses, while automating their AR processes, also consider adopting RDC and mobile payments. Remote Deposit Capture is a service offered that allows customers to scan checks and transmit check images to the bank. RDC can eliminate costs associated with lockbox services, transportation, and manual handling. Adoption of RDC and mobile payments could help businesses capture check payments and remittances accurately with the help of artificial intelligence and achieve straight-through cash posting with a hit-rate of 95%. - Automated Dunning

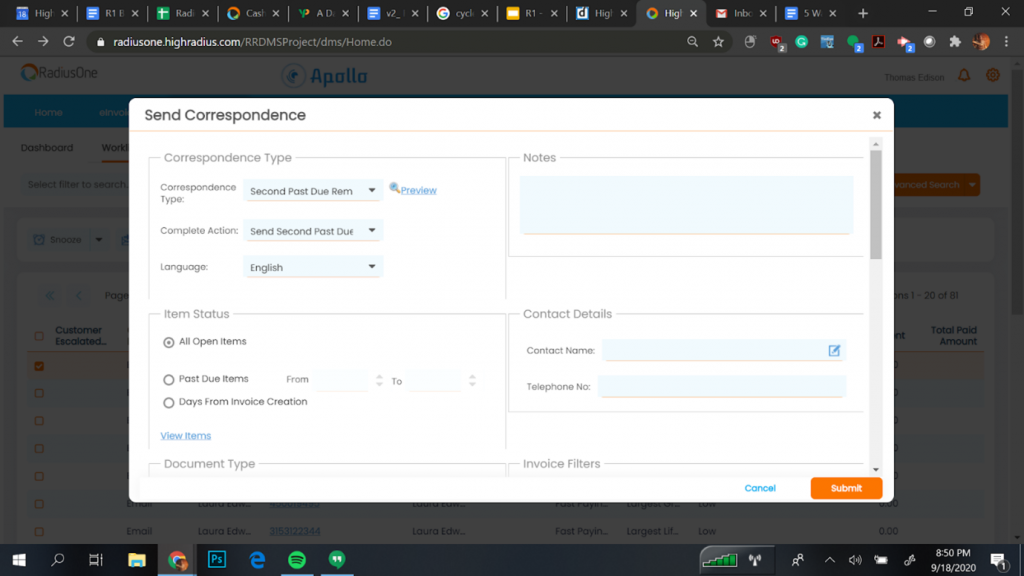

One of the key reasons for the cash crunch at mid-sized businesses is a poor collections process. Does your collections team spend a lot of time following up on accounts that are past due? Is delayed invoicing one of the key challenges that you face in collections? Automated dunning via email with easy-to-create correspondence templates could help in sending and tracking correspondence en masse. Moreover, features such as “send Invoice as attachment” or a “pay now” link embedded in dunning emails could make the payment process easier and simpler for customers, allowing businesses to get paid faster.

5.1 Send correspondence to your customers with easy-to-create correspondence templates, based on type, action, and language

With most A/R and A/P teams working remotely and businesses focussing on how to enable customers to pay them, the dynamic shift to digital payments is all but inevitable over the next few months. However, processing digital payments come with its own set of challenges from managing security risks, compliances, aggregating decoupled remittances, and invoice matching. In this scenario, technology might be the best host to help you through the crisis. The right A/R automation could help you fasttrack e-invoicing, enable customer self-service, automate cash application and automate collections correspondence to help your FTEs automate repetitive tasks and make a net positive impact on working capital and cash flow.

RadiusOne A/R Suite for Mid-sized Businesses

The Highradius RadiusOne A/R Suite includes a set of automation solution that could help mid-sized businesses:

• Minimize costs and resources for repetitive, clerical A/R work

• Lower DSO and invoice aging

• Improve working capital and cash conversion cycle.

In times of crisis, implementing an accounts receivable automation solution could be your best bet for minimizing operating costs and saving cash for running the business efficiently.

Contact your Account Executive for more on HighRadius.