Jul 19, 2023

Jul 19, 2023

by Experian – Gary Stockton

If the current economic cycle has you craving more insight into the small business sector you have come to the right place. We are delighted to release the Spring 2023 Beyond The Trends report. This release finds credit markets remaining largely open across risk tiers, but small business lenders will be more sensitive to market factors such as labor, wages, inflation, global supply chain disruptions, sanction activity, and rising delinquency trends as small businesses look for growth as consumer spending although strong, begins to moderate.

Here are a few highlights contained in the latest report:

Inflation-adjusted income has risen for seven-consecutive months.

Consumers spend as income acceleration continues. This spending increase does not mean that consumers are getting more value or products for the purchase volume.… Read the rest

May 24, 2023

Written By: Jason W. Alexander and Paxton L. Deuel from Sussman Shank LLP

If you are a contractor who performs work on tribal lands, you may wonder whether you can claim a construction lien if you are not paid. A construction lien secures your right to payment by the lien “attaching” to the property where you provided labor or materials and if you remain unpaid, you can foreclose the lien and force the sale of the property. However, claiming a construction lien on property within the jurisdiction of an Indian tribe is not as straightforward as claiming one on private property outside the jurisdiction of an Indian tribe. In fact, in most cases, it’s not possible at all.… Read the rest

May 24, 2023

Written By: Mark Tapia, United TranzActions

In the fast-paced world of business, efficiency and control are crucial to a company’s success. Accounts Payable (A/P) operations are a vital part of any organization, but it can often be a time-consuming and manual process that can hinder business growth. That’s why United TranzActions’ (UTA) NextGen A/P solution is a game-changer when it comes to automating and streamlining the processing of your Payables.

One of the standout features offered by this solution includes the improved visibility and control it provides. By eliminating paper and managing A/P from a central platform accessible anywhere, businesses can enjoy better visibility across user roles, business units, and locations. In addition, real-time analytics provide insights that help maintain better control over spend, giving businesses the power to make informed decisions and drive growth.… Read the rest

May 24, 2023

Jamilex Gotay, editorial associate

Bankruptcies are on the rise again, a trend tracing back to December of last year. Most notably for trade credit professionals, year-over-year commercial filings were up 24%. Chapter 11 cases (including Subchapter V) surged 79% compared to March 2022. Of the total commercial Chapter 11 filings, the 140 Subchapter V filings in March represented a 12% increase from the 125 filings in March 2022, per Epiq Bankruptcy. In order to maximize recovery for their company and minimize any additional risk exposure, trade creditors should consider the following tools:

#1 Sound Credit Procedures

Creating and following sound, written credit procedures is essential in mitigating losses. This entails keeping the credit application in the customer file, along with all documentation used to assess the creditworthiness of the customer.… Read the rest

May 24, 2023

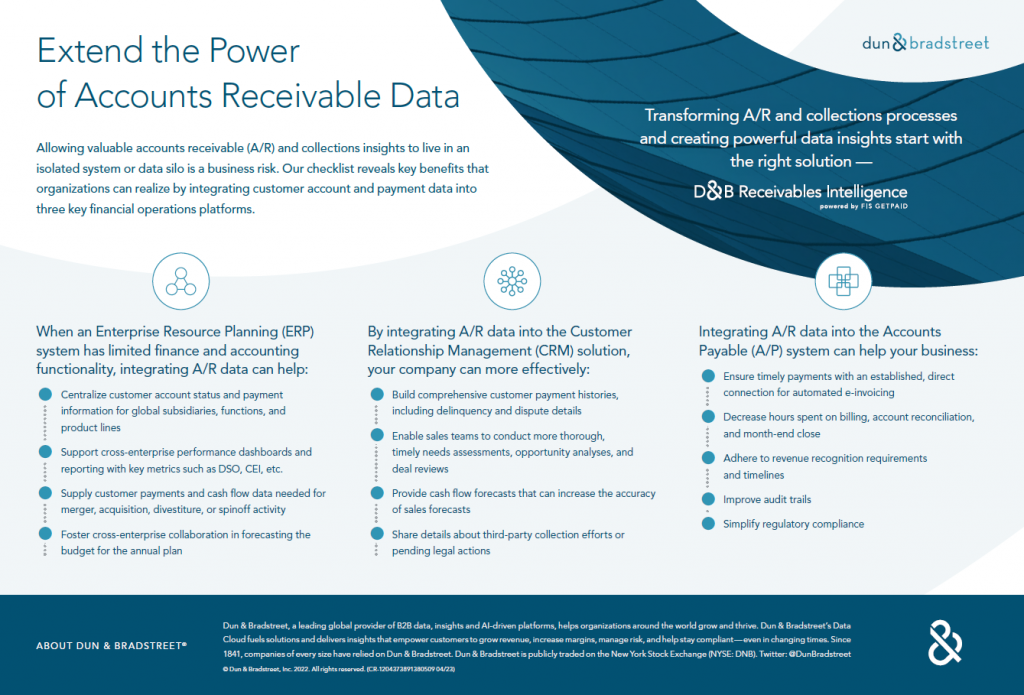

Allowing valuable accounts receivable (A/R) insights to live in data silos is a business risk. This checklist reveals key benefits of integrating customer account and payment data into three key financial operations platforms.

Contact NACM Commercial Services and your Account Executive for more information. Contact us at: www.nacmcs.org – customerservice@nacmcs.org – 800.622.6985

May 24, 2023

A big shoutout to all the amazing people who joined us, donated, spoke at, and sponsored our 2023 Annual Spring Membership Events in Denver, Portland, and Spokane! We are thrilled to announce that together, we have raised an incredible $10K for member scholarships through the NACM CS Foundation. This would not have been possible without your support and enthusiasm! Thank you, everyone, for making this a huge success!

Thank you to our Donors

AL Compressed Gases

Alaina Worden, CCE

Brett Hanft, CBA

Bruce Pac

CAD of Spokane

Cascade Nut & Bolt

Clara Nemeth, CCE CGA

Coast Cutlery

Columbia Grain International LLC

Columbia Sportswear Co

Connell Oil

Costco

CPM Development

Dunn Carney

Dupree Building Supplies

Erin Stammer

Fat Cupcake

Jen’s Pastries

Jennifer Walsh, CCE

John Hardy

Kathy Linscott

Keen Inc

Kilgore TEC Products

Kodiak BP LLC

Land View Inc

Larkens Vacura

Leatherman Tool Group

Mark Teeter , CCE CICP

Modern Glass Company

NACM Commercial Services

NACM National

Nutrien Ag Solutions

OrePac Building Products

Pacific Metal Company

Pacific Steel & Recycling

Pendleton Woolen Mills Inc

Sam Bennett

Schwabe Willamson

Shannon Abnal

Sheryl Rasmusson, CCE

Simple Sums

Star Rentals

WCP Solutions… Read the rest