Jan 21, 2021

December 2020 Report

Dun & Bradstreet’s U.S. Economic Health Tracker is a monthly, multi-dimensional review of the health of the economy.

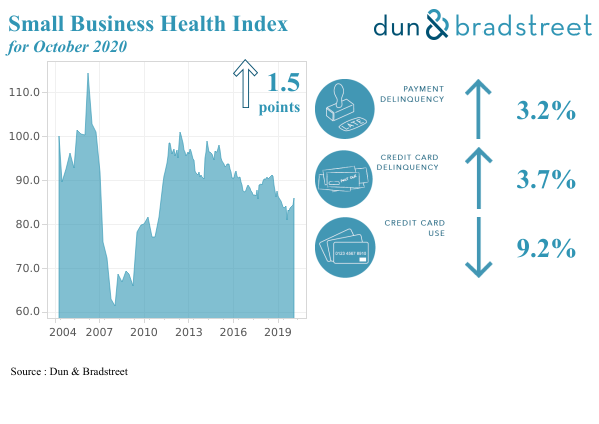

U.S. Small Business Health Index

The Small Business Health Index (SBHI) measures business health at the Metropolitan Statistical Area (MSA) and Industry (SIC) level as it relates to payment patterns, failure rates, and credit use. The SBHI follows a sampling of all active small businesses with fewer than 100 employees and combines pro- and counter-cyclical elements to provide a simple, representative number. Using 2004 as the base year (index value 100), improvement is designated by an index value above 100. The index is a combination of pro-cyclical and counter-cyclical elements – reflected in one number and is calculated quarterly. The SBHI is based on 4 factors:

- Average credit card utilization

- Percent of credit cards with outstanding balance cycle 3+ (61+ days past due)

- Ratio derived from the number of failures in the last 12 months over prior 12 months

- Percent of delinquent dollars 91+ days past due out of all outstanding balances

The U.S. Small Business Health Index registered a gain of 1.5 points over the current reporting period, the increase was primarily driven by increase in trade credit delinquencies. Although the overall index continued to decline slightly on an annual basis, some verticals like business services showed improvements. All major verticals across the board showed improvements on a m/m basis. The subcomponents of the overall index continued to show an increase in the delinquency rate on annual basis, but the rate of increase remains low compared to the past few months, signaling some recovery from the impact of the pandemic, at least over the short term.

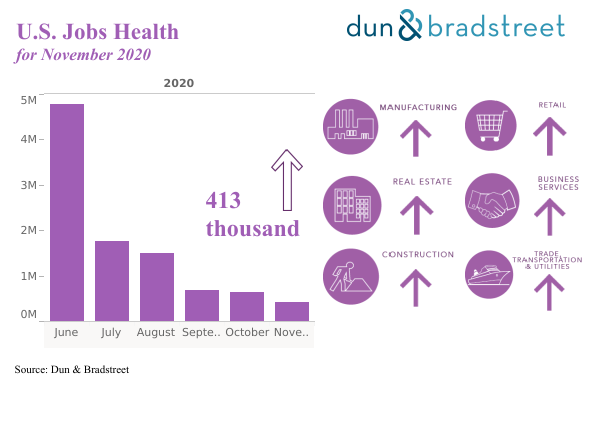

U.S. Jobs Health

U.S Jobs Health is comprised of Dun & Bradstreet’s proprietary indicators that forecast that the labor market, based on nonfarm payroll employment figures. It combines Small Business Health Index industry data with U.S. Bureau of Labor Statistics figures to forecast monthly nonfarm payroll employment.

The U.S labor market monthly gain is expected to level off further in the Nov. 2020 report, with the economy adding about 400K jobs over the past month. Conditions might worsen further due to several states experiencing a resurgence of the number of cases of and hospitalizations due to COVID-19 causing authorities to implement new restrictions on business and population activity. The timing of the availability of vaccines to the general population might be a key factor that drives the pace of employment gains in the coming months.

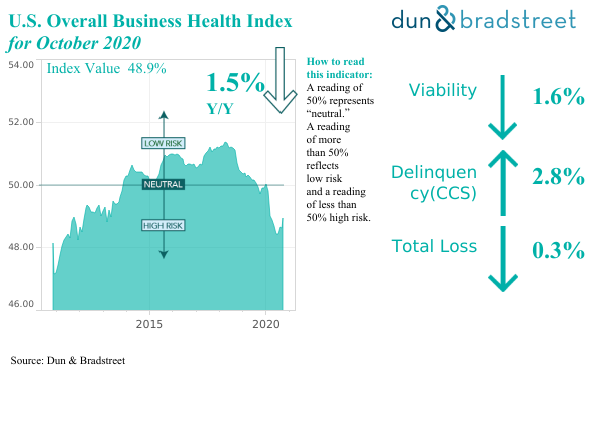

U.S. Overall Business Health Index

The U.S. Overall Business Health Index provides a weighted average of the D&B Viability Rating®, the D&B® Delinquency Predictor Score, and the D&B® Total Loss Predictor. The Overall Business Health Index (OBHI) measures the aggregate risk of a confirmed active and open businesses paying in a severely delinquent manner (91+ DPD), recording a first payment default or becoming no longer active. The index tracks conditions at both the geographic (National, census region, state and Metro Statistical Area) and industry level (SIC). The index provides a benchmark for determining business level financial stress. It ranges from zero (with all businesses recording high levels of risk) to 100% (with all businesses recording low levels of risk).

Month-to-month improvement in October of our Overall Business Health Index continues to signal that improving economic data is filtering through to our standard risk scores. The index rose 0.6% m/m while the y/y pace slowed to -1.5% which was the slowest annual pace since February of this year. The turn higher in recent months is promising but the majority of firms can be characterized as still significantly weak as indicated by the overall index remaining 1.1 percentage points below the 50% neutral line.

Perspectives

The Small Business Health Index spread some optimism over the current reporting period by recording a 12-month high – its highest level in 2020. All major verticals across the board showed improvements on a m/m basis with transportation, a sector hit hard by the pandemic showing the highest increase – possibly driven by the boost from holiday travelers. While seasonal activities may be a factor driving growth and employment gains over the final quarter of this year, it also brings along resurgence of COVID-19 in several parts of the country. The balance between easing of restrictions and spread of the disease has been a tough one to achieve and may possibly be the key factor that decides the path of the economy.

Meanwhile, the persistent improvement in our Overall Business Health Index (OBHI) continues to indicate that first payment default risk, severely delinquent payment risk (91+DPD) and the risk of a business becoming no longer viable is fading. In October, the index rose to a seven-month high with all subcomponents recording sequential improvement. Furthermore, improvement at the regional and sectoral levels were broad based this month but variations between those levels remain widespread. Our Commercial Credit Score remains the weakest aggregate subcomponent score and that indicates that while aggerate level risk of a firm becoming no longer viable remains lower, payment performance and the timing of repayment remains a high concern.

Report based on data available as of November 27, 2020.