Sep 16, 2020

Background

COVID-19 is having a profound impact on millions of businesses and their customers, especially from a cashflow perspective. Many small businesses are having trouble meeting their payment obligations. These types of payment and cash flow challenges consequently highlight the need for lenders and business creditors to more effectively manage these risks. Based on the current economic environment, lenders and trade creditors need to take proactive steps to analyze exposure within their commercial portfolios, assess account-level performance, segment those accounts by

risk, and create a strategy to manage risks.

Common business challenges for today’s economic climate

- — Before the current economic environment, lenders forecasted bad rates in their commercial portfolios based on past account performance and used traditional scoring in a less frequent cadence and focused on portfolio review. Credit managers are now adding to their risk management toolkit, seeking out more real-time means of managing up to thousands of potentially impacted accounts.

- — Credit managers face several challenges, including setting a baseline for present-day portfolio performance, segmenting the portfolio into risk classes, and monitoring the other 80% of accounts that aren’t at risk.

- — Commercial credit managers struggle to immediately identify accounts posing a higher risk, which may delay their efforts to adjust credit terms proactively, apply treatment strategies, or actively initiate collection efforts.

Lenders and trade creditors continue to seek new ways to gain insights into their customers’ business behavior and status changes in near real-time to limit risks within their portfolios while remaining agile enough to help these small businesses survive. Given the size of the commercial portfolios and dollars at risk, lenders and trade creditors need an automated solution to monitor their portfolios and get updated information on the fiscal health of accounts. Experian provides triggers on many different risk events and automatically sends alerts whenever there’s a change to an existing account, which helps lenders and trade creditors actively manage high-risk accounts and monitor other emerging risks.

Developing an effective strategy for portfolio management is equally as important as merely putting one in place. Experian provides the capability to notify clients of 99 potential trigger events. Still, lenders and trade creditors may get overwhelmed, trying to monitor too many notifications. Understanding what event alerts are most predictive of future outcomes and at what thresholds to apply filters will help create the most effective program for proactive monitoring.

Overview — Account Monitoring ServiceSM triggers

The Experian Commercial Data Sciences team performed an analysis of Experian’s Account Monitoring Service triggers and developed some best practice approaches for implementing an effective trigger program.

Account Monitoring Service triggers are grouped into three categories

1. Score changes — Monitor commercial credit score changes to receive alerts and assess account changes when scores migrate beyond thresholds.

For example, Intelliscore Plus SM v2, Financial Stability Risk ScoreSM and Small Business Credit ShareSM scores

2. Filings — Monitor high-risk legal filings occurring within your commercial portfolio. These filings denote a higher probability of distress and future resiliency challenges.

3. Derogatory behavior — These triggers denote negative comments reported by trade contributors on accounts in your portfolio. These comments provide a view into other negative interactions your customer is having with other creditors.

The three categories described contain 99 triggers based on Experian’s extensive commercial credit database. Within this set of triggers, for Small Business Credit Share consortium members, 20 triggers are exclusively designed for program participants.

Best practices

Each Account Monitoring Service trigger is predictive in and of itself. Still, the strategic approach is to utilize these triggers in combination to isolate and identify high-risk occurrences and effect action. The recommended strategy is to use triggers in conjunction to balance the number of occurrences with the prediction of potential risk. Combinations of triggers and trigger velocities within a short period can significantly increase monitoring predictiveness.

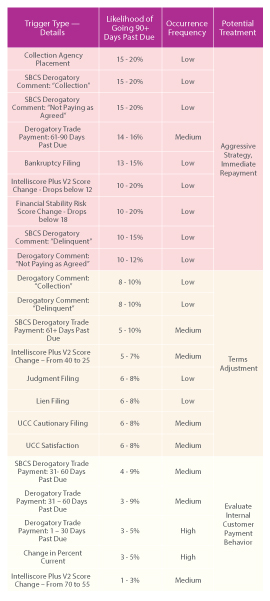

Experian’s Commercial Data Sciences team has identified the following triggers that are consistently the most predictive. Lenders and trade creditors can consider the following potential treatment strategies that correlate to these occurrences:

Conclusion

No one can confidently predict what will happen next, as there are many unknowns in the current market. But with Experian’s Account Monitoring Services, lenders and trade creditors can improve their ability to detect customer problems early and take action to reduce risk within their portfolio. With this proactive approach, lenders and trade creditors can identify changes in small business behavior early so that they can begin working on establishing new terms that are effective and agreeable.

Let Experian help you with your risk management strategy

For more information on Experian please contact your Account Executive or Customer Service.