Nov 30, 2023

This Report is being republished with permission from RetailStat

Throughout 2023, consumers have maintained their spending resiliency amid macroeconomic headwinds. However, the data reflects spending has shifted to higher-priced essentials and back to leisure, travel and other services, while sales of discretionary goods have mostly declined. On the plus side of the economic ledger, in addition to strong consumer spending, the job market remains strong, real wages are growing and inflation is finally falling. However, there is also plenty to worry about. Interest rates are the highest since the beginning of the Great Recession, the stimulus impact is fading, and savings, especially among the lower half of consumers, are being depleted while debt increases. Although most consumers were able to lock in the historically low mortgage rates during the pandemic, new home buyer budgets are being stretched: the monthly cost of a new mortgage is now 42% of the U.S. median household income—10 percentage points higher than on the eve of the 2008 housing crash (UBS).

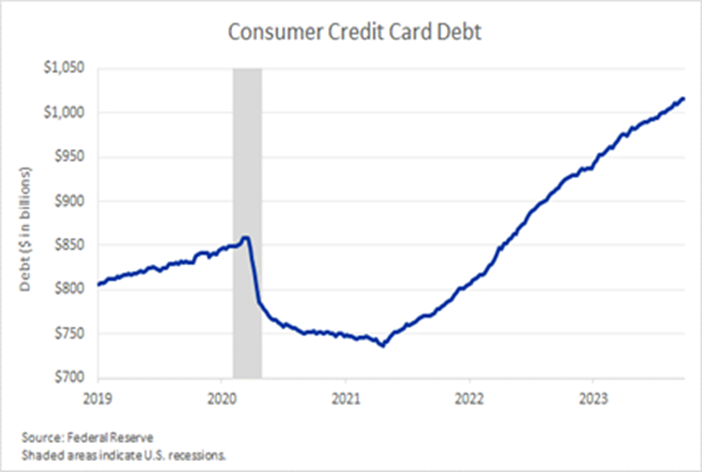

Credit card debt is on the rise. The New York Federal Reserve reported credit card balances grew 5% to top $1 trillion in 2Q, and delinquencies are climbing again. Bankrate reported that credit card rates have topped 20%. For over 40 million Americans, loan payments on the $1.600 trillion in student debt resumed this month, averaging an estimated average of $200 to $300 monthly, or 5% of median salary (Wells Fargo). There are also labor strikes, a potential government shutdown, war in the Middle East and the ongoing Ukraine conflict to consider.

Despite increasing macroeconomic headwinds, retail sales are forecast to grow in the low- to mid-single digits this holiday season. However, many, like PwC and Adobe, forecast that growth will depend on more and early discounting.

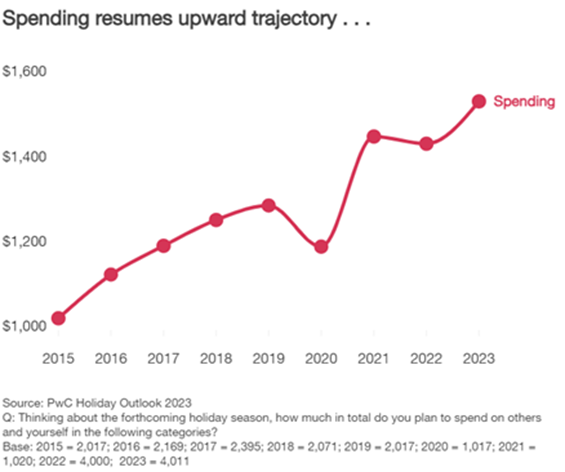

PwC said consumers would increase holiday spending a healthy 7% this year, allocating an average of $1,530 for gifts, travel and entertainment. Those with household incomes of $120,000 or more will exceed an average of $3,000, while households with incomes less than $25,000 and $150,000 will spend 18% more this year. Other big spenders include newer generations of shoppers, travelers and emerging tech users, including increased use of AI to assist in shopping. PwC said Gen Z’s are expected to lead spending growth, up 15% and with 58% expected to travel, followed by increases of 14%, 12% and 11% by mature millennials, Gen X and women, respectively. The travel boom will continue into the winter, with travel spending expected to grow 12% over the 2022 holiday season. PwC also reported that more than 75% of consumers expect deals, and most are expected to do the bulk of their shopping in early November.

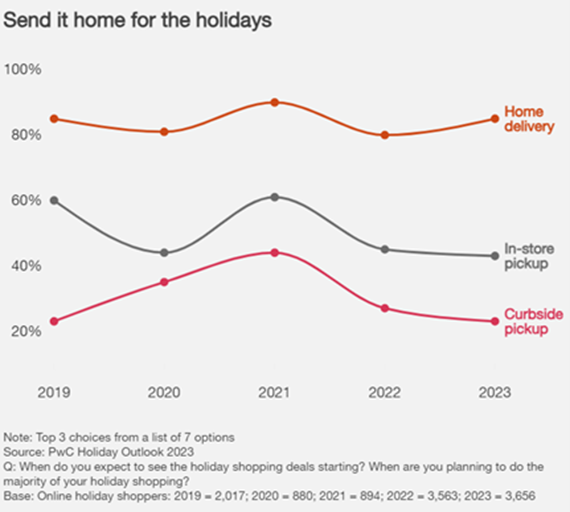

Per PwC, home delivery is expected to dominate online shopping, while in-store and curbside pickup will see slight declines.

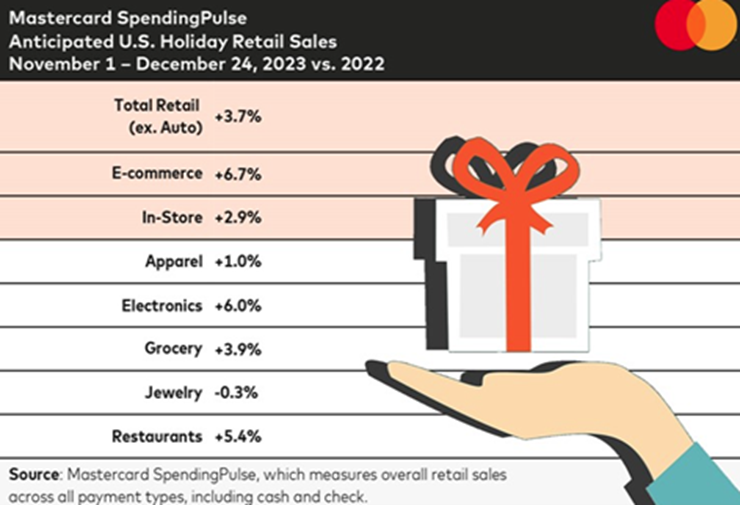

Deloitte expects holiday sales growth between 3.5% and 4.6% to about $1.55 trillion, compared to 7.6% growth during the 2022 holiday season (November to January), driven by healthy employment and income growth. Online sales are expected to grow 10.3% to 12.8%, resulting in sales between $278 billion and $284 billion. Meanwhile, Mastercard projects similar 3.7% growth this year, including 6.7% online growth and 2.9% in-store sales growth. Mastercard said, “After years of inventory and spending habits being in flux, the 2023 season will bring a broader rebalancing across categories, channels, and sectors in alignment with macroeconomic trends.”

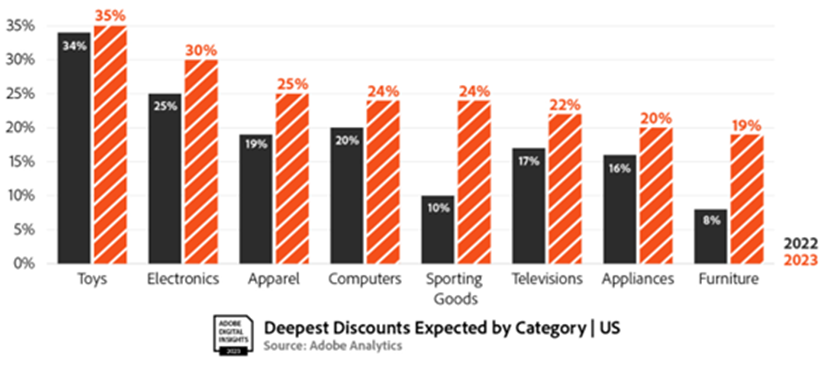

According to Adobe, online sales are expected to grow 5% to $222 billion this holiday season, with discounts of up to 35% off list price expected, depending on the category. Toys and Electronics are expected to see the highest discounts at 35% and 30%, respectively. Sporting Goods and Furniture will experience the largest jump in promotional activity from last year, up 14% and 11%, respectively. To jumpstart the season, retailers are announcing holiday sales promotions as early as October 1st as they attempt to pull forward as many sales as possible.

Some examples of early promotional activity include the following:

- Target and Best Buy will kick off holiday promotions this year, starting October 1st. Target is running an exclusive week-long promotional period for its Target Circle members, offering up to 40% off goods.

- Best Buy will be running month-long deals for the entire month of October, offering flash sales and varying promotional events week by week.

- Walmart announced its 2023 Top Toy List on August 22, featuring 25 toys under $25, and ran its official holiday kickoff event from October 9 to October 12.

A National Retail Federation (NRF) survey revealed that, like last year, consumers plan to shop early and continue spending into the holiday season.

In addition to credit card spending, more consumers are choosing Buy Now, Pay Later (BNPL) shopping schemes. Adobe surveyed one in five consumers who plan to use BNPL to purchase gifts, and total spending on these transactions is expected to grow 17% to reach $17 billion this holiday season. Year-to-date BNPL spending was up 15% to $47 billion.

Looking at the key Cyber week period—Thanksgiving, Black Friday and Cyber Monday— Adobe predicts $37.20 billion in online spending, up 5.4% from last year and representing 16.8% of the holiday season. Cyber Monday is anticipated to reach $12 billion in sales, followed by Black Friday at $9.60 billion and Thanksgiving at $5.60 billion.

Many retailers have announced their hiring plans for this season. Amazon seems bullish, announcing plans to hire 100,000 more seasonal employees (warehouse and fulfillment) than last year, totaling 250,000. Target announced hiring plans in line with last year, at 100,000. Macy’s and Dick’s Sporting Goods announced plans to hire fewer workers than in 2022; Macy’s plans to hire about 38,000 seasonal workers, 3,000 below its 2022 plan, and Dick’s said it would hire 8,600 seasonal workers, down from 9,000 last year. Meanwhile, UPS said it would employ 100,000 this year, the same number as in 2022.

Walmart’s hiring plans remain under wraps; in 2022, it planned to fill 40,000 seasonal positions. Historically, holiday sales tend to fall in line with or come out stronger than the back-to-school season.

Walmart’s Executive VP, CEO, and President John R. Furner stated on the 2Q conference call, “What’s making me feel a little bit better is the run rate compared to the previous quarter and how back-to-school started. And typically, when back-to-school is strong, it bodes well for what happens with Halloween and Christmas in GM in the back half.” Like BTS shopping, consumers are expected to start shopping for the upcoming holidays earlier than ever.

Conclusion

While it’s still early in the holiday cycle, based on back-to-school and preliminary Halloween experiences, consumers look like they’re ready to spend, even if that means funding the bulk of purchases on credit or BNPL schemes. Strong merchandising, omnichannel options, and, of course, deep discounts will be key to driving traffic. Omnichannel fulfillment is expected to be strong, with consumers increasingly choosing mobile ordering, especially younger generations. In line with recent trends, online sales are likely to see the biggest gains, as the BTS season saw 55% of consumers purchase items through online channels. As for retailers, better-controlled inventory levels and improved supply chains have supported margins in 1H23 and will be critical to preserving margins during the holidays as consumers shop for bargains.

This report is issued to the Subscriber for its exclusive use only and is compiled from sources which RetailStat, LLC (“RetailStat”), does not control and unless indicated is not verified. RetailStat, its principals, analysts, writers and agents do not guarantee the accuracy, completeness or timeliness of the information provided nor do they assume responsibility for the information reported herein nor for failure to report any matter omitted or withheld. This report and/or any part thereof may not be reproduced, and/or transmitted in any manner whatsoever. Any reproduction and/or transmission without the written consent of RetailStat is in violation of Federal and State Law.